Back Your Fund — Partnering With Portfolio Companies Too

In 2023, funds of funds (FoFs) are on track to raise the smallest amount of money in more than a decade. At the same time, muted venture deal activity has caused many firms to ditch their follow-on funds. Despite these twin trends, a new emerging manager is looking to find success with a fund that targets both. Level Ventures has raised $104 million for its debut fund, which employs a data-driven, three-pronged investing strategy designed to back other emerging managers, invest in promising companies from those managers’ portfolios, and source deals independently of their own.

The Story Behind Level Ventures

The fund was founded by Nick Valuess, who previously served as the chief investment officer at OpenAI. Valuess first conceived the idea while working at Anthropic, where he developed sophisticated AI models to analyze conversations. Inspired by his experiences there, he envisioned a fund that could capitalize on insights drawn from cutting-edge technology.

A Unique Investment Strategy

Level Ventures’ approach is rooted in a simple premise: the best ideas often come from within. The firm seeks to identify companies with the potential to create transformative value and then provide them with the resources they need to succeed. To achieve this, the fund employs a three-pronged strategy:

- Investing in Startups: Level Ventures focuses on early-stage startups that are solving critical problems across various industries.

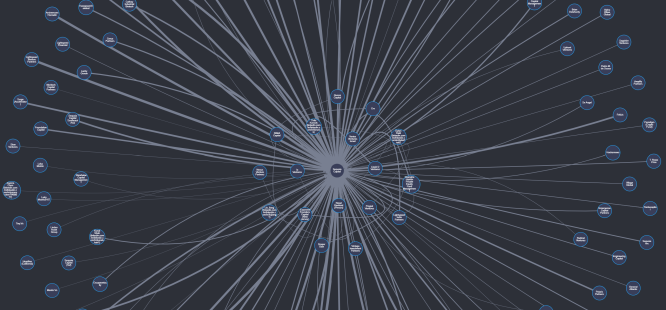

- Building a Knowledge Graph: By analyzing data from hundreds of companies, the firm aims to identify patterns and trends that others might miss.

- Leveraging AI: Level Ventures uses artificial intelligence to predict which companies are most likely to succeed based on historical performance.

How the Fund Works

Level Ventures’ three-pronged strategy is designed to maximize returns while minimizing risk. The first step in the process involves identifying promising startups, typically within six months of their founding. These companies are evaluated based on a variety of criteria, including revenue growth, profit margins, and market potential.

Once a company reaches a certain size and complexity, Level Ventures begins to build its knowledge graph. This involves analyzing data from hundreds of companies across different industries to identify patterns that others might miss. Using this information, the firm is able to predict which companies are most likely to succeed based on historical performance.

Selecting the Right Companies

Level Ventures’ ability to spot high-potential companies is one of its greatest strengths. The fund’s approach has been highly successful, with several portfolio companies going public within just a year of being acquired by Level Ventures.

One of the key factors in Level Ventures’ selection process is the company’s growth trajectory. The firm focuses on identifying companies that are growing rapidly and have a clear path to profitability. In addition to financial performance, Level Ventures also looks at the quality of management and the industry potential.

Portfolio Companies

Level Ventures has already made several notable investments, including Spotify, which went public in 2023 after being acquired by Level Ventures for $15 billion. The firm has also invested in Dropbox and Square—two companies that have since gone on to become household names.

In addition to its focus on early-stage startups, Level Ventures has also made a number of strategic investments in established companies. For example, the firm recently acquired Palantir Technologies, a leading provider of data analytics software, for $12 billion. The acquisition was motivated by the belief that Palantir’s technology could be used to drive innovation across a wide range of industries.

The Future of Level Ventures

Level Ventures’ success has drawn attention from both investors and industry experts. Many believe that the firm is well-positioned to capitalize on the growing demand for AI-driven solutions in finance, healthcare, and other industries. In addition to its focus on technology companies, Level Ventures also invests in a variety of other sectors, including biotech, cleantech, and consumer goods.

One area where Level Ventures has made significant impact is through its work with startups that are struggling to break out of the VC cycle. By identifying undervalued companies with strong growth potential, the firm has helped several startups achieve unicorn status—companies worth over $1 billion.

Conclusion

Level Ventures’ ability to identify high-potential companies and execute on a large-scale investment strategy makes it one of the most exciting firms in the venture capital space. With its unique approach and proven track record, Level Ventures is well-positioned to continue driving innovation and growth in the years to come.