Bitcoin Sees Largest Price Increase in Over a Year with 12 Percent Rally

Market Recap

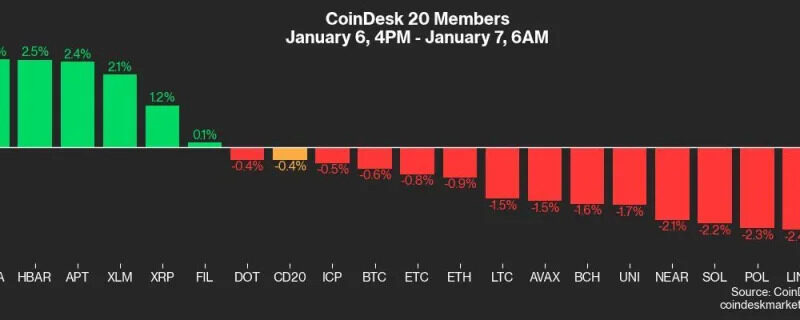

The cryptocurrency market has seen a significant recovery in recent days, with Bitcoin (BTC) surging nearly 12% to $61,720 on Thursday alone. This is the biggest single-day gain since February 28, 2022, according to charting platform TradingView.

Risk Assets Stabilize Amid Upbeat Jobs Data

The rally in risk assets, including cryptocurrencies, has been driven by better-than-expected U.S. jobs data, which eased recession concerns and pushed U.S. stocks higher. The Wall Street fear index, VIX, fell to 23, offering positive cues to risk assets.

Key Levels to Watch Out For

According to Alex Kuptsikevich, senior market analyst at FxPro, the level of $61,800 is key for the bulls. If Bitcoin can close above this level, it could encourage buyers to rally quickly to $67K. A retreat from this level would set up a scenario of a return to the area of the sustained July and August lows near $55.5K.

Support at $54,000 Holds Strong

Investment Advisor Two Prime notes that the bias remains bullish while prices hold support at $54,000. Geopolitical issues and Federal Reserve policy will be key drivers for the next big price moves.

Whales Accumulate BTC During Price Crash

According to blockchain analytics firm Santiment, whales or wallets with large BTC holdings accumulated the cryptocurrency during Monday’s price crash. August 5th and 6th saw the highest level of Bitcoin whale transactions since the first week of April.

U.S.-Listed Spot ETFs Attract Investor Funds

The U.S.-listed spot exchange-traded funds (ETFs) have amassed $194.6 million in investor funds, the highest tally since July 2022, according to Farside Investors. BlackRock’s IBIT alone drew $157.6 million in investments.

Market Cap Rises 11%

The total crypto market capitalization rose 11% to $2.11 trillion on Thursday, the biggest jump since November 10, 2022.

Bank of Japan Pushes Back Against Rate Hikes

The Bank of Japan has pushed back against near-term rate hikes, which has stalled the rally in the anti-risk Japanese yen. This is a positive cue for risk assets, including cryptocurrencies.

MicroStrategy Bags Another 1,070 BTC

MicroStrategy, a well-known investor in Bitcoin, has acquired another 1,070 BTC, bringing its total holdings to over 129,000 coins.

Investors Take Note: $61,800 and $54,000 are Key Levels

As the market continues to rally, investors should keep a close eye on the key levels of $61,800 and $54,000. A break above or below these levels could have significant implications for the price of Bitcoin.

Why the Recession Concerns Are Waning

The better-than-expected U.S. jobs data has eased recession concerns, which is driving the rally in risk assets. The VIX index has also fallen to 23, offering positive cues to risk assets.

What’s Next?

As the market continues to recover, investors will be watching closely for any signs of a potential reversal. Geopolitical issues and Federal Reserve policy will be key drivers for the next big price moves.

Bitcoin Whales Accumulate During Price Crash

According to Santiment, whales or wallets with large BTC holdings accumulated the cryptocurrency during Monday’s price crash. This is a positive sign for the market, as it suggests that there are still buyers in the market willing to accumulate at lower prices.

Investors Take Note: $54,000 and $50,000 Are Key Support Levels

As the market continues to rally, investors should keep a close eye on the key support levels of $54,000 and $50,000. A break below these levels could have significant implications for the price of Bitcoin.

Conclusion

The cryptocurrency market has seen a significant recovery in recent days, with Bitcoin surging nearly 12% to $61,720 on Thursday alone. The rally is driven by better-than-expected U.S. jobs data, which has eased recession concerns and pushed U.S. stocks higher. Investors should keep a close eye on the key levels of $61,800 and $54,000, as these will be crucial for determining the next direction of the market.

References

- TradingView: Bitcoin price rally since February 28, 2022

- Farside Investors: U.S.-listed spot ETFs attract investor funds

- Santiment: Whales accumulate BTC during Monday’s price crash

- Two Prime: Investment Advisor notes bullish bias and support at $54,000

- CoinDesk: Alex Kuptsikevich comments on key levels to watch out for