Crypto Rally Stopped by DOJ Investigation into Tether

Introduction

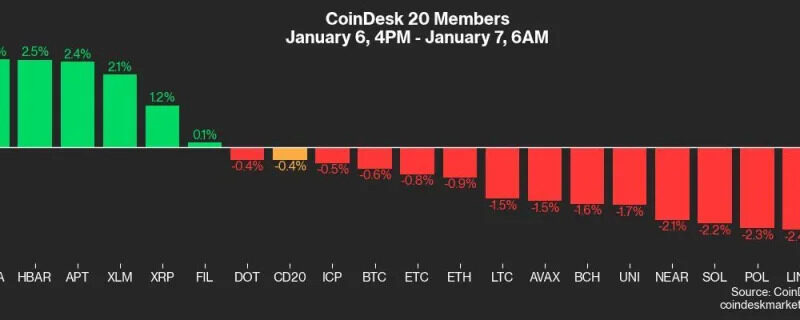

Cryptocurrency prices have experienced a notable reversal of early gains, with most major coins trading lower during U.S. afternoon hours on Friday. This market shift follows a widely circulated Wall Street Journal report that has sparked heightened scrutiny of stablecoin issuer Tether (USDT). The article details the investigation into Tether for alleged violations of sanctions and anti-money laundering regulations, prompting mixed reactions from market participants.

What Are Stablecoins?

Stablecoins are a category of cryptocurrencies designed to provide stability by anchoring their value to tangible assets or fiat currencies. Unlike traditional cryptocurrencies, which can fluctuate widely due to speculative factors, stablecoins aim for relative consistency in value. The most recognized example is the U.S. Dollar Coin (Dollar Coin), though others like Euro Coin and British Pound Coin also exist.

History And Functionality

Stablecoins have emerged as a critical component of the decentralized finance (DeFi) ecosystem, enabling trustless transactions without requiring a centralized authority. They are often used as collateral in borrowing protocols or as alternatives to fiat currency in cross-border payments. Tether, one of the largest stablecoin issuers by market capitalization, dominates this space with its USDT offering.

Market Context Before The Report

Prior to the WSJ report, cryptocurrency markets had shown promising signs. Bitcoin (BTC), the leading cryptocurrency, had approached the $69,000 milestone, signaling potential for a significant price point in coming weeks or months. This upward trajectory had fueled optimism among investors seeking opportunities in the volatile cryptocurrency space.

Reaction From MicroStrategy

In response to the WSJ report, institutional crypto assets manager MicroStrategy has taken a notable position by adding an additional 1,070 BTC to its holdings. This move underscores the growing confidence of institutional players in Bitcoin’s long-term potential despite the recent market fluctuations. However, the broader market reaction remains uncertain, with prices still adjusting to the latest developments.

Reaction From Tether And WSJ

The WSJ report has drawn sharp criticism from both industry stakeholders and regulators. Stablecoin issuer Tether (USDT) has released a statement dismissing the allegations, emphasizing that no investigation is currently pending. The company’s Chief Executive Officer, Paolo Ardoino, however, expressed frustration with what he described as "old noise" from the WSJ.

Update On Investigation

An update from Tether following the report indicates that no formal investigation has been initiated by U.S. authorities. Ardoino confirmed that Tether is not currently under scrutiny, maintaining its position as a reliable stablecoin issuer. This clarification has helped mitigate some of the market sentiment around the company’s stability.

Broader Market Implications

The WSJ report and related reactions have had a ripple effect across the crypto ecosystem. While some experts predict that the price volatility may abate once the investigation concludes, others caution against overreacting to short-term news. The ongoing instability in stablecoin markets has further highlighted the need for stricter regulations to ensure transparency and prevent systemic risks.

Conclusion

Cryptocurrency markets remain highly sensitive to developments like this WSJ report on Tether. As regulators, institutions, and investors continue to navigate the complexities of stablecoins and their role in the broader financial landscape, the price dynamics of cryptocurrencies are likely to evolve further. Investors should approach these fluctuations with a cautious eye, leveraging comprehensive market analysis to make informed decisions.