The Bank of Canada’s “inflation buffet” clouds the timing of potential interest rate reductions.

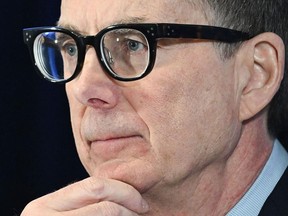

The Bank of Canada has six indexes it monitors to gauge underlying price pressures, but Governor Tiff Macklem has pushed back against focus on a specific indicator, describing core inflation as more of a concept.

A Mixed Bag of Measures

Core inflation measures are crucial guideposts for economists, meant to strip out extreme price fluctuations and provide a better sense of where price pressures are headed. However, the bank’s reliance on multiple metrics can be confusing and limit transparency.

Macklem’s Approach

In January, Macklem emphasized that underlying inflation is more of a concept than a measure. He stated that he wouldn’t put a specific number on what level of core inflation would prompt a lowering of the benchmark interest rate from its current five per cent.

Economists Weigh In

Stephen Brown of Capital Economics runs his own calculations to strip out mortgage and rent components, which are often excluded in official data. He believes that failing to exclude these measures means the bank will keep interest rates high for too long and condemn the economy to a weaker period than is needed.

Veronica Clark at Citigroup Inc. focuses on core rates themselves, as well as the three-month moving measures. She’s expecting the first cut in July, citing the complexity of forecasting core inflation due to changing components every month.

Shelter Inflation

Macklem has signalled that officials may be starting to reach similar conclusions, saying that monetary policy can’t solve housing shortages driving up costs. This suggests policymakers may consider looking beyond shelter inflation as they weigh how long to keep interest rates at current levels.

The Central Bank’s Track Record

The bank has a track record of abandoning some core inflation measures while redirecting focus on others. Working with Statistics Canada, the bank introduced three new ‘preferred measures’ of core price trends in 2017. However, one of these, CPI-common, was discarded at the end of 2022 after substantial revisions and a major disconnect from headline inflation.

An "Inflationary Buffet"

CIBC’s Tal described the myriad core metrics as an ‘inflationary buffet.’ A hawkish central bank might choose to focus on those with above three per cent inflation, while a less hawkish bank will focus on those closer to two per cent. The tone of Macklem’s press conference will become increasingly more important than any new data releases.

The Bottom Line

The Bank of Canada’s reliance on multiple core inflation measures makes it challenging to forecast the timing of interest rate cuts. As policymakers weigh their options, they must consider the complexity of underlying price pressures and the need for clear downward momentum in inflationary pressures.

Recommended Readings

- Bank of Canada to halt QT program within months

- BoC believes interest rates need more time to work

- Bank of Canada can’t solve housing crisis, Macklem says

Join the Conversation

Share your thoughts on this article by commenting below.