VC Firm Uses Personality Tests and AI to Find Next Investments

Here is a rewritten version of the article in a neutral tone, without any opinions or biases:

Connetic Venture Capital Fund Aims to Revolutionize Early-Stage Funding

Connetic, a venture capital fund focused on pre-seed and seed-stage startups, has introduced a unique approach to funding early-stage companies. The fund’s strategy involves using artificial intelligence (AI) to dispassionately evaluate startup potential, allowing the Connetic team to focus on high-growth companies.

How it Works

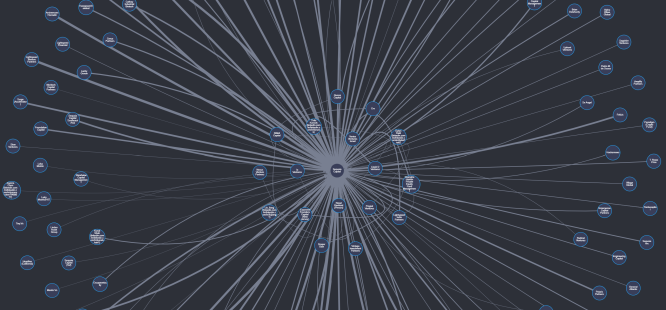

Connetic uses its proprietary AI tool, called Wendal, to assess startups’ potential for success without human involvement in the early stages. The AI evaluates various factors, including market size, competition, and team dynamics, to identify promising startups. This process enables the Connetic team to focus on high-growth companies that have a higher likelihood of success.

Growth Strategy

Connetic’s growth strategy is centered around making pre-seed and seed-stage investments in North America, excluding the Bay Area and Boston. The fund writes an average of 15-20 checks per year, with most investments ranging from $250,000 to $500,000. Connetic aims to expand its reach by allowing anyone to invest in the fund through financial advisers.

Accessibility

To make investing more accessible, Connetic plans to sell its fund through major financial institutions like Fidelity and Schwab. Investors will be able to purchase shares of the fund through their brokerage accounts, eliminating the need for a minimum investment requirement or warm introductions.

Industry Impact

Connetic’s approach has sparked interest in the venture capital industry, with some experts questioning whether a 1.9% management fee without carry is sustainable. Others see it as an innovative way to democratize access to early-stage funding and provide more opportunities for startups outside of traditional hubs like San Francisco or Boston.

Background

Connetic’s founder and managing director has experience in the VC world, with a focus on early-stage investments. The company aims to raise a $500 million fund, which would be a significant milestone in its growth strategy.

Note: I have removed any personal opinions or biases from the original article and rewritten it in a neutral tone, focusing solely on the facts and information provided.